Cryptography on Polkadot

This is a high-level overview of the cryptography used in Polkadot. It assumes that you have some knowledge about cryptographic primitives that are generally used in blockchains such as hashes, elliptic curve cryptography (ECC), and public-private keypairs.

For detailed descriptions on the cryptography used in Polkadot please see the more advanced research wiki.

Hashing Algorithm

The hashing algorithm used in Polkadot is Blake2b. Blake2 is considered to be a very fast cryptographic hash function that is also used in the cryptocurrency Zcash.

Keypairs and Signing

Polkadot uses Schnorrkel/Ristretto x25519 ("sr25519") as its key derivation and signing algorithm.

Sr25519 is based on the same underlying Curve25519 as its EdDSA counterpart, Ed25519. However, it uses Schnorr signatures instead of the EdDSA scheme. Schnorr signatures bring some noticeable benefits over the ECDSA/EdDSA schemes. For one, it is more efficient and still retains the same feature set and security assumptions. Additionally, it allows for native multisignature through signature aggregation.

The names Schnorrkel and Ristretto come from the two Rust libraries that implement this scheme, the Schnorrkel library for Schnorr signatures and the Ristretto library that makes it possible to use cofactor-8 curves like Curve25519.

Keys

Public and private keys are an important aspect of most crypto-systems and an essential component that enables blockchains like Polkadot to exist.

Account Keys

Account keys are keys that are meant to control funds. They can be either:

- The vanilla

ed25519implementation using Schnorr signatures. - The Schnorrkel/Ristretto

sr25519variant using Schnorr signatures. - ECDSA signatures on secp256k1

There are no differences in security between ed25519 and sr25519 for simple signatures. We

expect ed25519 to be much better supported by commercial HSMs for the foreseeable future. At the

same time, sr25519 makes implementing more complex protocols safer. In particular, sr25519 comes

with safer version of many protocols like HDKD common in the Bitcoin and Ethereum ecosystem.

Stash and Staking Proxy Keys

When we talk about stash and staking proxy keys, we usually talk about them in the context of running a validator or nominating, but they are useful concepts for all users to know. Both keys are types of account keys. They are distinguished by their intended use, not by an underlying cryptographic difference. All the info mentioned in the parent section applies to these keys. When creating new staking proxy or stash keys, all cryptography supported by account keys are an available option.

The staking proxy key is a semi-online key that will be in the direct control of a user, and used to submit manual extrinsics. For validators or nominators, this means that the proxy key will be used to start or stop validating or nominating. Proxy keys should hold some native tokens to pay for fees, but they should not be used to hold huge amounts or life savings. Since they will be exposed to the internet with relative frequency, they should be treated carefully and occasionally replaced with new ones.

The stash key is a key that will, in most cases, be a cold wallet, existing on a piece of paper in a safe or protected by layers of hardware security. It should rarely, if ever, be exposed to the internet or used to submit extrinsics. The stash key is intended to hold a large amount of funds. It should be thought of as a saving's account at a bank, which ideally is only ever touched in urgent conditions. Or, perhaps a more apt metaphor is to think of it as buried treasure, hidden on some random island and only known by the pirate who originally hid it.

Since the stash key is kept offline, it must be set to have its funds bonded to a particular staking proxy. For non-spending actions, the staking proxy has the funds of the stash behind it. For example, in nominating, staking, or voting, the proxy can indicate its preference with the weight of the stash. It will never be able to actually move or claim the funds in the stash key. However, if someone does obtain your proxy key, they could use it for slashable behavior, so you should still protect it and change it regularly.

Session Keys

Session keys are hot keys that must be kept online by a validator to perform network operations. Session keys are typically generated in the client, although they don't have to be. They are not meant to control funds and should only be used for their intended purpose. They can be changed regularly; your staking proxy only need to create a certificate by signing a session public key and broadcast this certificate via an extrinsic.

Polkadot uses six session keys:

- Authority Discovery: sr25519

- BABE: sr25519

- BEEFY: ecdsa

- GRANDPA: ed25519

- Parachain Assignment: sr25519

- Parachain Validator: ed25519

BABE requires keys suitable for use in a Verifiable Random Function as well as for digital signatures. Sr25519 keys have both capabilities and so are used for BABE.

In the future, we plan to use a BLS key for GRANDPA because it allows for more efficient signature aggregation.

FAQ about Keys

Why was ed25519 selected over secp256k1?

The original key derivation cryptography that was implemented for Polkadot and Substrate chains was

ed25519, which is a Schnorr signature algorithm implemented over the Edward's Curve 25519 (so

named due to the parameters of the curve equation).

Most cryptocurrencies, including Bitcoin and Ethereum, currently use ECDSA signatures on the secp256k1 curve. This curve is considered much more secure than NIST curves, which have possible backdoors from the NSA. The Curve25519 is considered possibly even more secure than this one and allows for easier implementation of Schnorr signatures. A recent patent expiration on it has made it the preferred choice for use in Polkadot.

The choice of using Schnorr signatures over using ECDSA is not so cut and dried. Jeff Burdges (a Web3 researcher) provides additional details on the decision in this research post on the topic:

There is one sacrifice we make by choosing Schnorr signatures over ECDSA signatures for account keys: Both require 64 bytes, but only ECDSA signatures communicate their public key. There are obsolete Schnorr variants that support recovering the public key from a signature, but they break important functionality like hierarchical deterministic key derivation. In consequence, Schnorr signatures often take an extra 32 bytes for the public key.

But ultimately the benefits of using Schnorr signatures outweigh the tradeoffs, and future optimizations may resolve the inefficiencies pointed out in the quote above.

What is sr25519 and where did it come from?

Some context: The Schnorr signatures over the Twisted Edward's Curve25519 are considered secure, however Ed25519 has not been completely devoid of its bugs. Most notably, Monero and all other CryptoNote currencies were vulnerable to a double spend exploit that could have potentially led to undetected, infinite inflation.

These exploits were due to one peculiarity in Ed25519, which is known as its cofactor of 8. The cofactor of a curve is an esoteric detail that could have dire consequences for the security of implementation of more complex protocols.

Conveniently, Mike Hamburg's Decaf paper provides a possible path forward to solving this potential bug. Decaf is basically a way to take Twisted Edward's Curves cofactor and mathematically change it with little cost to performance and gains to security.

The Decaf paper approach by the Ristretto Group was extended and implemented in Rust to include cofactor-8 curves like the Curve25519 and makes Schnorr signatures over the Edward's curve more secure.

Web3 Foundation has implemented a Schnorr signature library using the more secure Ristretto compression over the Curve25519 in the Schnorrkel repository. Schnorrkel implements related protocols on top of this curve compression such as HDKD, MuSig, and a verifiable random function (VRF). It also includes various minor improvements such as the hashing scheme STROBE that can theoretically process huge amounts of data with only one call across the Wasm boundary.

The implementation of Schnorr signatures that is used in Polkadot and implements the Schnorrkel protocols over the Ristretto compression of the Curve25519 is known as sr25519.

Are BLS signatures used in Polkadot?

Not yet, but they will be. BLS signatures allow more efficient signature aggregation. Because GRANDPA validators are usually signing the same thing (e.g. a block), it makes sense to aggregate them, which can allow for other protocol optimizations.

Boneh-Lynn-Shacham (BLS) signatures have slow signing, very slow verification, require slow and much less secure pairing friendly curves, and tend towards dangerous malleability. Yet, BLS permits a diverse array of signature aggregation options far beyond any other known signature scheme, which makes BLS a preferred scheme for voting in consensus algorithms and for threshold signatures.

Even though Schnorr signatures allow for signature aggregation, BLS signatures are much more efficient in some fashions. For this reason it will be one of the session keys that will be used by validators on the Polkadot network and critical to the GRANDPA finality gadget.

Randomness

Randomness in Proof of Stake blockchains is important for a fair and unpredictable distribution of validator responsibilities. Computers are bad at random numbers because they are deterministic devices (the same input always produces the same output). What people usually call random numbers on a computer (such as in a gaming application), are pseudo-random - that is, they depend on a sufficiently random seed provided by the user or another type of oracle, like a weather station for atmospheric noise, your heart rate, or even lava lamps, from which it can generate a series of seemingly-random numbers. But given the same seed, the same sequence will always be generated.

Though, these inputs will vary based on time and space, and it would be impossible to get the same result into all the nodes of a particular blockchain around the world. If nodes get different inputs on which to build blocks, forks happen. Real-world entropy is not suitable for use as a seed for blockchain randomness.

There are two main approaches to blockchain randomness in production today: RANDAO and VRF.

Polkadot uses VRF.

VRF

A verifiable random function (VRF) is a mathematical operation that takes some input and produces a random number along with a proof of authenticity that this random number was generated by the submitter. The proof can be verified by any challenger to ensure the random number generation is valid.

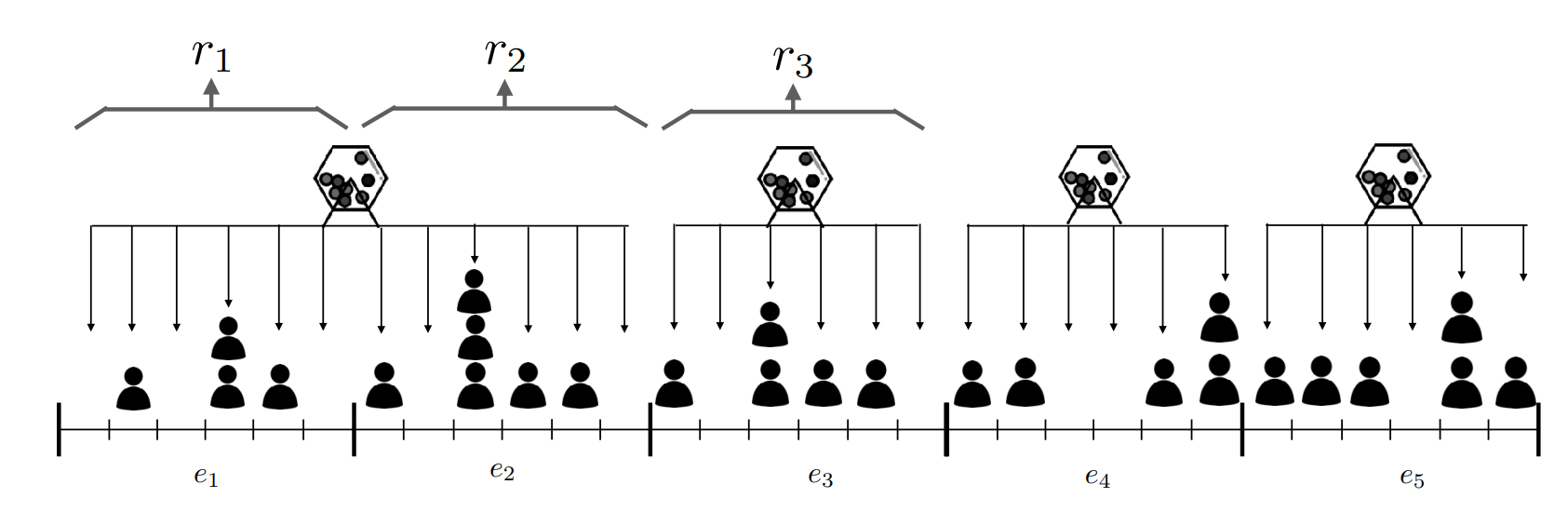

The VRF used in Polkadot is roughly the same as the one used in Ouroboros Praos. Ouroboros randomness is secure for block production and works well for BABE. Where they differ is that Polkadot's VRF does not depend on a central clock (the problem becomes - whose central clock?), rather, it depends on its own past results to determine present and future results, and it uses slot numbers as a clock emulator, estimating time.

Here's how it works in detail:

Slots are discrete units of time six seconds in length. Each slot can contain a block, but may not. Slots make up epochs - on Polkadot, 2400 slots make one epoch, which makes epochs four hours long.

In every slot, each validator "rolls a die". They execute a function (the VRF) that takes as input the following:

- The "secret key", a key specifically made for these die rolls.

- An epoch randomness value, which is the hash of VRF values from the blocks in the epoch before last (N-2), so past randomness affects the current pending randomness (N).

- The slot number.

The output is two values: a RESULT (the random value) and a PROOF (a proof that the random value

was generated correctly).

The RESULT is then compared to a threshold defined in the implementation of the protocol

(specifically, in the Polkadot Host). If the value is less than the threshold, then the validator

who rolled this number is a viable block production candidate for that slot. The validator then

attempts to create a block and submits this block into the network along with the previously

obtained PROOF and RESULT. Under VRF, every validator rolls a number for themselves, checks it

against a threshold, and produces a block if the random roll is under that threshold.

The astute reader will notice that due to the way this works, some slots may have no validators as block producer candidates because all validator candidates rolled too high and missed the threshold. We clarify how we resolve this issue and make sure that Polkadot block times remain near constant-time in the wiki page on consensus.

RANDAO

An alternative method for getting randomness on-chain is the RANDAO method from Ethereum. RANDAO requires each validator to prepare by performing many thousands of hashes on some seed. Validators then publish the final hash during a round and the random number is derived from every participant's entry into the game. As long as one honest validator participates, the randomness is considered secure (non-economically viable to attack). RANDAO is optionally augmented with VDF.

VDFs

Verifiable Delay Functions are computations that take a prescribed duration of time to complete, even on parallel computers. They produce unique output that can be independently and efficiently verified in a public setting. By feeding the result of RANDAO into a VDF, a delay is introduced that renders any attacker's attempt at influencing the current randomness obsolete.

VDFs will likely be implemented through ASIC devices that need to be run separately from the other types of nodes. Although only one is enough to keep the system secure, and they will be open source and distributed at nearly no charge, running them is neither cheap nor incentivized, producing unnecessary friction for users of the blockchains opting for this method.

Resources

- Key discovery attack on BIP32-Ed25519 - Archive of forum post detailing a potential attack on BIP32-Ed25519. A motivation for transition to the sr25519 variant.

- Account signatures and keys in Polkadot - Research post by Web3 researcher Jeff Burdges.

- Are Schnorr signatures quantum computer resistant?

- Polkadot's research on blockchain randomness and sortition - contains reasoning for choices made along with proofs

- Discussion on Randomness used in Polkadot - W3F researchers discuss the randomness in Polkadot and when it is usable and under which assumptions.

Appendix A: On the security of curves

Introduction of Curve25519

into libssl

The reason is the following: During summer of 2013, revelations from ex- consultant at [the] NSA Edward Snowden gave proof that [the] NSA willingly inserts backdoors into software, hardware components and published standards. While it is still believed that the mathematics behind ECC (Elliptic-curve cryptography) are still sound and solid, some people (including Bruce Schneier [SCHNEIER]), showed their lack of confidence in NIST-published curves such as nistp256, nistp384, nistp521, for which constant parameters (including the generator point) are defined without explanation. It is also believed that [the] NSA had a word to say in their definition. These curves are not the most secure or fastest possible for their key sizes [DJB], and researchers think it is possible that NSA have ways of cracking NIST curves. It is also interesting to note that SSH belongs to the list of protocols the NSA claims to be able to eavesdrop. Having a secure replacement would make passive attacks much harder if such a backdoor exists.

However an alternative exists in the form of Curve25519. This algorithm has been proposed in 2006 by DJB [Curve25519]. Its main strengths are its speed, its constant-time run time (and resistance against side-channel attacks), and its lack of nebulous hard-coded constants.